Life Insurance ~ Life’s full of the unexpected.

But, will you be prepared when the unthinkable happens? This type of insurance is a way to prepare in advance for the worst possible situation that can occur. It helps protect your family and your assets when they need it the most.

In the event of the unthinkable, we’re here to guarantee the financial security your family will need to move forward in the future.

There are many types of insurance policies available to most people.

The most common types of policies are “Term“, “Whole” and “Universal“. How do you know which type is best suited for your situation?

“Term” life ins can be a good option for a young family with a limited budget, whereas a “Whole” life ins policy might be more appropriate for the long-haul.

There are many different reasons for buying life insurance. The most common reason is to protect your family in the case of a premature death.

In the event of an unexpected death, the death benefits can be used to pay off your home mortgage, fund your children’s college, and provide adequate income for the surviving spouse and children.

It is also a way to protect your assets from estate taxes.

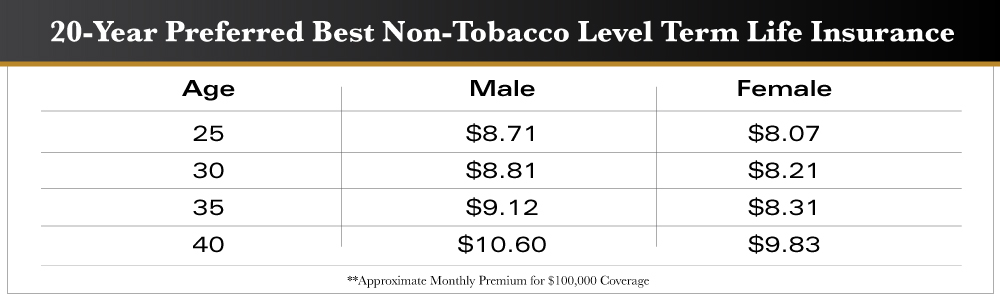

So, how far can your dollar go? How much coverage do you need to carry? How much money do your loved ones need when you die?

When you decide to buy a policy, you may struggle with choosing the right face amount to cover the financial needs of loved ones left behind. Our trusted agents can help you analyze your particular situation and assist in determining what coverage you need!

We offer many types of policies, from a variety of companies so that we best suit your needs.

Monday – Thursday: 8:00am-5:00pm

Friday: 8:00am-4:00pm

Saturday – Sunday: Closed

We use cookies and browser activity to improve your experience, personalize content and ads, and analyze how our sites are used. For more information on how we collect and use this information, please review our Privacy Policy here. California consumers may exercise their CCPA rights here.